People believe in miracles and fall into trouble even with free access to various sources of information and all the necessary data to avoid financial fraudsters. An American criminal, former entrepreneur and financier Bernard Madoff took advantage of such naivety. He created the largest pyramid scheme in the history of the United States, for which he was imprisoned for life. His sons reported to the FBI the truth about the scam. Read more about this story on queenski.com.

What is a pyramid scheme?

A pyramid scheme is a type of fraud that works due to investors. The financial structure attracts funds by promising depositors super-high returns. Whenever a new investor comes in, the first depositors are paid out. Hierarchy is characteristic of the pyramid scheme. Investments of new participants are used to pay profits to previous ones. The later the person invests money in the pyramid scheme, the greater the chance of losing it.

The pyramid scheme collapses when the flow of funds from new investors stops completely. The longer it exists, the harder it is to solicit new participants. If the pyramid scheme is revealed, only its creators and the first investors will be able to profit. Everyone else will lose money. This approach is also called a Ponzi scheme, in honor of the swindler Charles Ponzi.

A pyramid scheme can be recognized by several features:

- high promises of profit in a short period

- lack of a real product or service

- dependence on new investors

- secrecy (lack of regular financial reports, documentation and proper information about the structure)

- aggressive marketing (advertising with wordless appeals and bright pictures, which is often placed on dubious resources)

- unclear terms used during a conversation with a potential investor (allegedly demonstrating professionalism but misleading)

- a small initial contribution (a small amount makes it possible to reach a large number of potential investors and avoid lawsuits in the case of non-return of the deposit).

Madoff Investment Securities Fraud Company

Bernard Madoff was born on April 29, 1938 in Queens to a family of Polish Jews. His parents worked as stock market investors for many years but were unsuccessful. After graduation, Bernard studied political science at the University of Alabama and Hofstra University. In addition, he attended Brooklyn Law School but left after his first year to open his business.

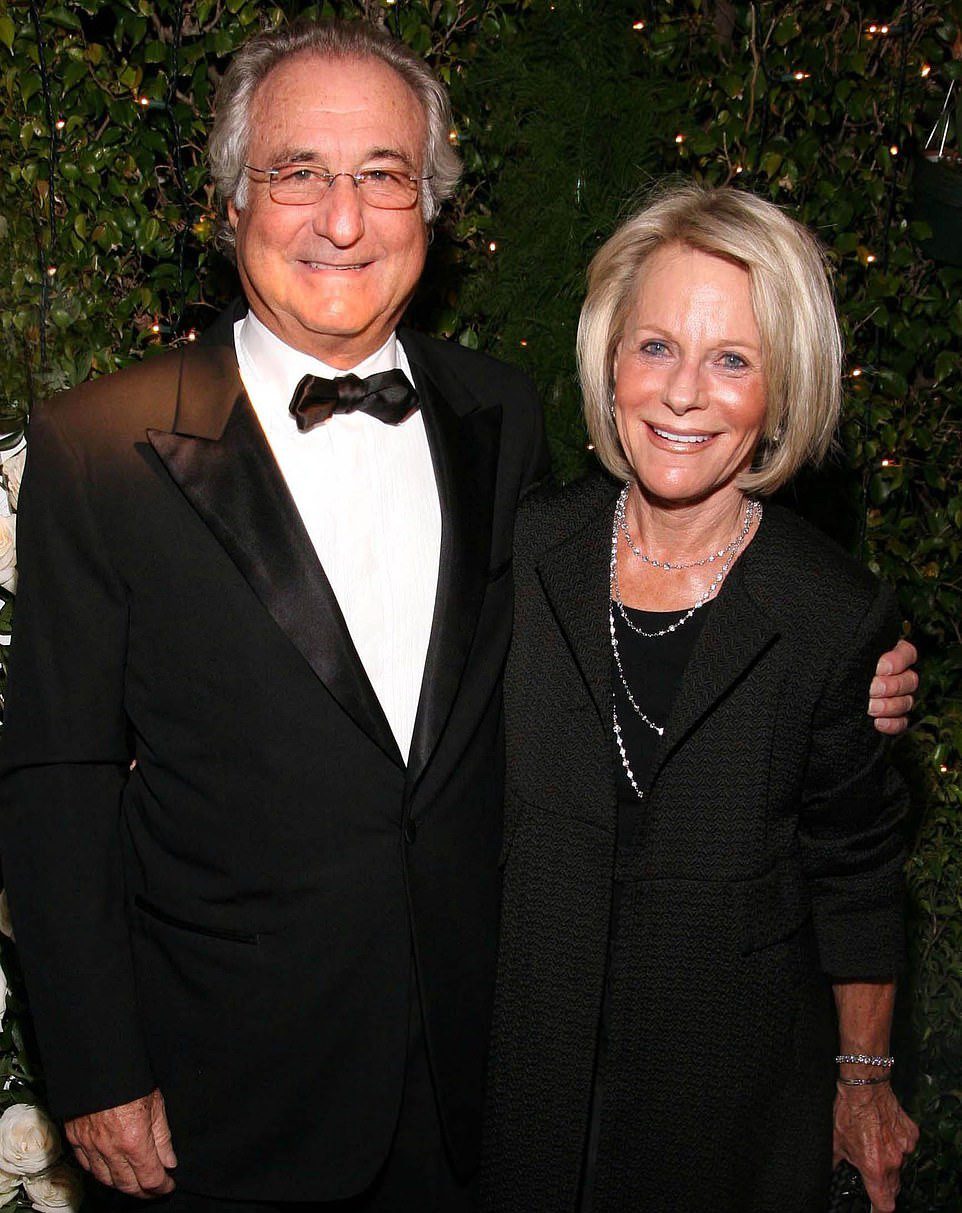

In 1959, Madoff legalized a relationship with Ruth Alpern, who worked on Wall Street after receiving a degree in psychology. Bernard was not interested in investments until 1960. Then, he created his own company, Madoff Investment Securities LLC. To open it, he used the savings he had accumulated while working as a lifeguard on the beach and due to some other jobs.

Ruth’s father helped Bernard attract famous Hollywood investors, such as Steven Spielberg and Kevin Bacon. Madoff Investment Securities LLC offered investors annual returns of 10% and accumulated a large capital over time.

Madoff maintained friendly relations with influential businessmen in New York and Florida, attracting them as investors. In addition, he developed relationships with financial regulators. Bernard used the principle of exclusivity, so that not everyone could join his company. This contributed to attracting only wealthy investors and created a prestige effect.

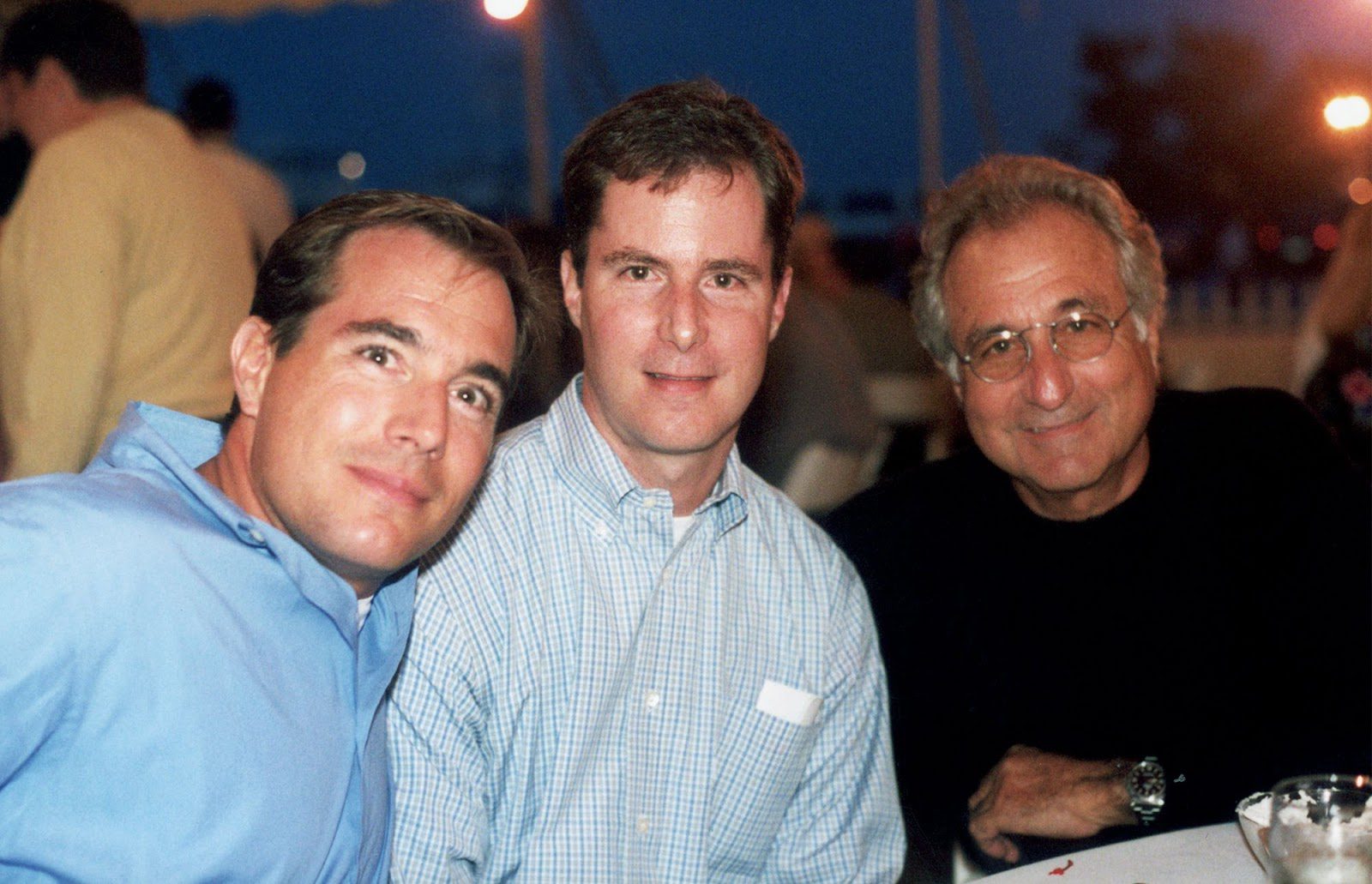

His two sons and his brother also worked in Madoff’s company. Madoff was one of the first financiers to use computer technology to develop a stock quote, a price tag that indicates their availability and cost to buy/sell. In 2000, Madoff’s company had approximately $300 million in assets and had several branches in New York and London. The list of investors included prominent Americans, Hollywood stars, etc.

The collapse of the pyramid scheme

The longevity of Madoff’s scheme was made possible primarily by financial foundations, which pooled other investors’ money and then placed it under Madoff Investment Securities LLC’s management. This way, these funds received millions of dollars in profit. Individual investors often did not even know that their funds were managed by Madoff’s company.

In 2001, the financial newspaper Barron’s published an article that made readers question Madoff’s integrity. Some skeptics concluded that the promised 10% annual return was not credible. In addition, the fact that the auditor of such a large-scale company is a tiny store with a small number of employees raised doubts. Employees of Madoff’s company were instructed to create false trading records and false monthly reports for investors.

At the same time, the Federal Securities and Exchange Commission did not suspect anything until the onset of the financial crisis in 2008. While Madoff Investment Securities LLC was making steady returns of 10% each year, other companies were suffering huge losses. In November 2008, when the share price fell, many investors wanted to withdraw money from accounts. The total amount was more than $7 billion. Madoff couldn’t do it. At the same time, his sons and other employees of his company had enough money for bonuses. When the sons asked their father about this situation, Madoff told them the truth about the pyramid scheme. The sons immediately reported the fraud to the Federal Bureau of Investigation.

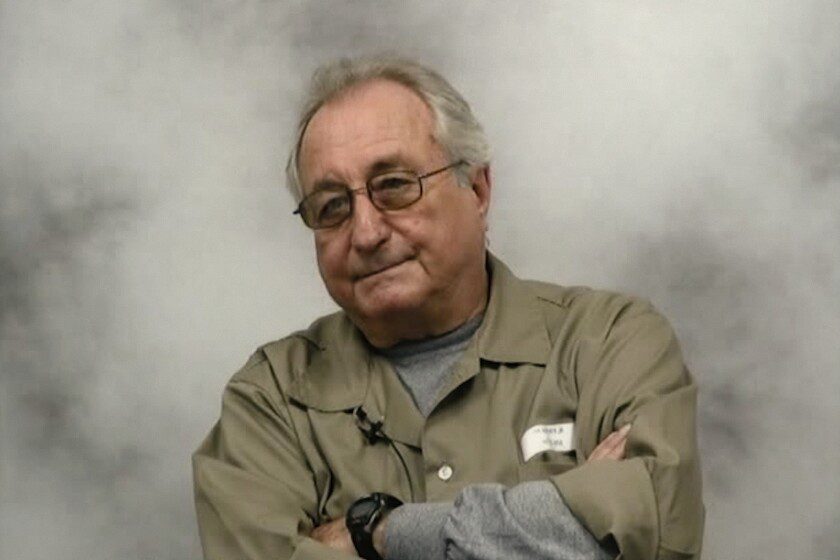

150 years of imprisonment

Bernard Madoff was arrested on December 11, 2008. In March 2009, he confirmed his involvement in the crimes. The swindler claimed that a pyramid scheme existed at Madoff Investment Securities LLC for many years, with investors receiving profits that were actually investments from new investors.

His accountant was also accused of securities fraud. He avoided imprisonment because he didn’t know the truth. Thousands of people and funds who invested in Madoff Investment Securities LLC suffered huge financial losses. In just three years of operation, Madoff earned more than $50 billion thanks to investors.

In June 2009, he was sentenced to 150 years in prison. Some investors still tried to return lost investments to relatives of Madoff and his wife, although no official charges were brought against them. Ruth was forced to sell houses in France, a private jet and other expensive objects.

The eldest son Mark committed suicide by hanging himself in his own apartment because of this story. As for Bernard, he experienced his first fight in the prison yard with another prisoner in October 2009. As Madoff began serving his sentence, his stress levels became so high that he soon developed hives and other skin conditions. In 2019, Madoff asked Donald Trump for a reduced sentence or pardon, which the White House did not respond to.

In April 2021, he died in a federal prison for special needs prisoners in North Carolina at the age of 82. He was previously diagnosed with hypertension (increased blood pressure), atherosclerotic heart disease and chronic kidney failure.